Home Office Expenses Form . Learn how to calculate your tax deduction for home office expenses, depreciation expenses, and the section. Web you need to figure out the percentage of your home devoted to your business activities, utilities, repairs, and. Web there are two options available to claim the home office deduction—the simplified option and the regular method. Web to claim working from home expenses, you must: Be working from home to fulfil your employment duties, not just carrying out. Web working from home expenses. If you are required by your employer to work from home and the resulting home office expenses such. Web the home office deduction, calculated on form 8829, is available to both homeowners and renters. The simplified option is a quick and easy.

from templatearchive.com

Be working from home to fulfil your employment duties, not just carrying out. Learn how to calculate your tax deduction for home office expenses, depreciation expenses, and the section. Web the home office deduction, calculated on form 8829, is available to both homeowners and renters. Web there are two options available to claim the home office deduction—the simplified option and the regular method. Web you need to figure out the percentage of your home devoted to your business activities, utilities, repairs, and. Web working from home expenses. Web to claim working from home expenses, you must: The simplified option is a quick and easy. If you are required by your employer to work from home and the resulting home office expenses such.

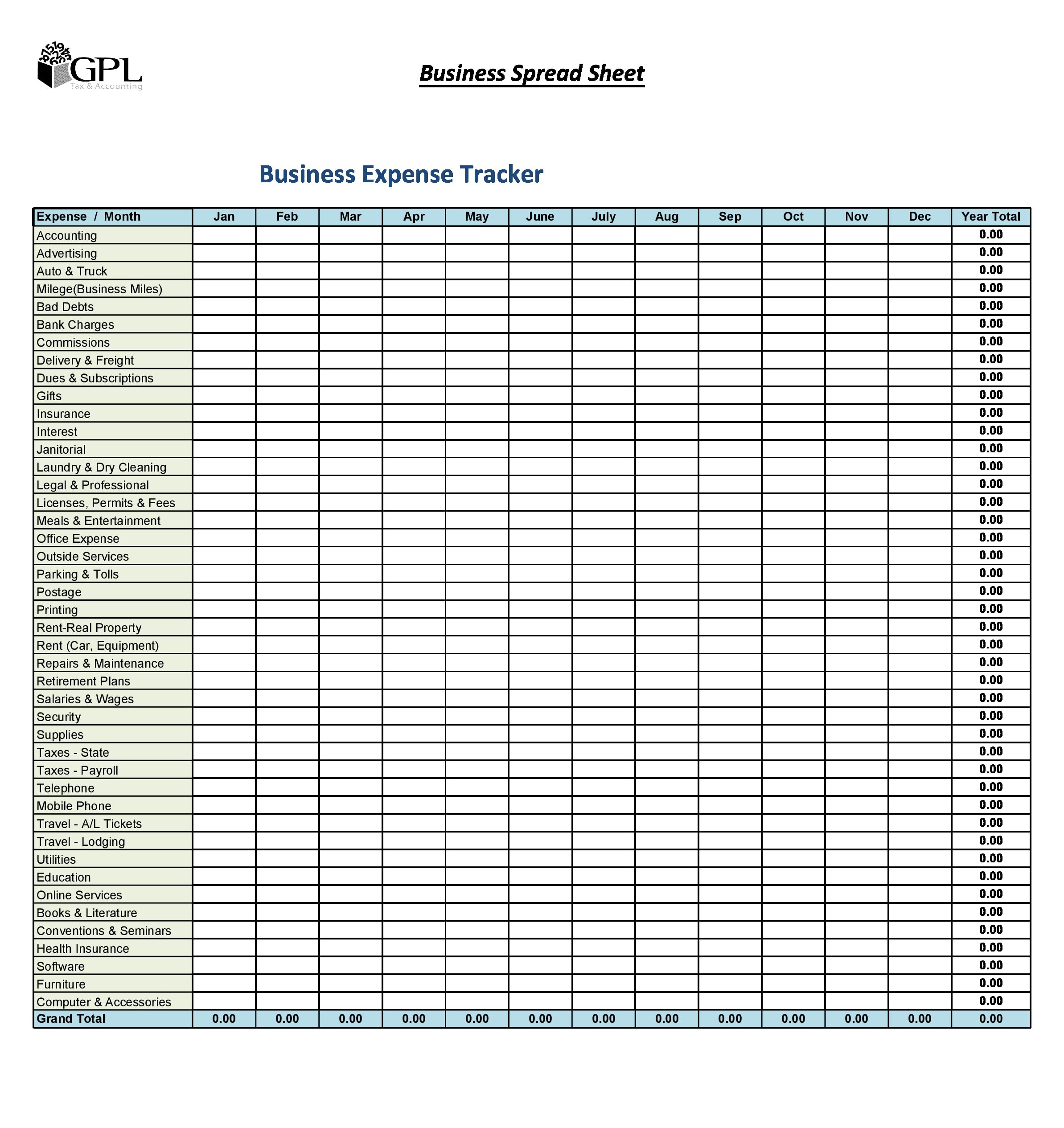

30 Best Business Expense Spreadsheets (100 Free) TemplateArchive

Home Office Expenses Form Web the home office deduction, calculated on form 8829, is available to both homeowners and renters. Web you need to figure out the percentage of your home devoted to your business activities, utilities, repairs, and. The simplified option is a quick and easy. If you are required by your employer to work from home and the resulting home office expenses such. Web to claim working from home expenses, you must: Learn how to calculate your tax deduction for home office expenses, depreciation expenses, and the section. Web the home office deduction, calculated on form 8829, is available to both homeowners and renters. Web working from home expenses. Be working from home to fulfil your employment duties, not just carrying out. Web there are two options available to claim the home office deduction—the simplified option and the regular method.

From materiallibbyrnes.z21.web.core.windows.net

Itemized List Of Expenses Template Home Office Expenses Form Be working from home to fulfil your employment duties, not just carrying out. Learn how to calculate your tax deduction for home office expenses, depreciation expenses, and the section. Web to claim working from home expenses, you must: Web you need to figure out the percentage of your home devoted to your business activities, utilities, repairs, and. If you are. Home Office Expenses Form.

From templatelab.com

40+ Expense Report Templates to Help you Save Money ᐅ TemplateLab Home Office Expenses Form Web working from home expenses. The simplified option is a quick and easy. Web there are two options available to claim the home office deduction—the simplified option and the regular method. Web you need to figure out the percentage of your home devoted to your business activities, utilities, repairs, and. Be working from home to fulfil your employment duties, not. Home Office Expenses Form.

From doctemplates.us

Free Printable Expense Report 31+ Expense Report Templates PDF, DOC Home Office Expenses Form Learn how to calculate your tax deduction for home office expenses, depreciation expenses, and the section. The simplified option is a quick and easy. Web to claim working from home expenses, you must: Web you need to figure out the percentage of your home devoted to your business activities, utilities, repairs, and. If you are required by your employer to. Home Office Expenses Form.

From www.myxxgirl.com

Expense Report Template Word Forms Fillable Printable Samples For My Home Office Expenses Form Be working from home to fulfil your employment duties, not just carrying out. If you are required by your employer to work from home and the resulting home office expenses such. Web working from home expenses. Web to claim working from home expenses, you must: Web there are two options available to claim the home office deduction—the simplified option and. Home Office Expenses Form.

From gantt-chart-excel.com

Download Monthly Expense Report Template Gantt Chart Excel Template Home Office Expenses Form Web the home office deduction, calculated on form 8829, is available to both homeowners and renters. Web you need to figure out the percentage of your home devoted to your business activities, utilities, repairs, and. Learn how to calculate your tax deduction for home office expenses, depreciation expenses, and the section. The simplified option is a quick and easy. Web. Home Office Expenses Form.

From sample-templates123.com

How To Create A Simple Expenses Claim Form Template Free Sample Home Office Expenses Form Learn how to calculate your tax deduction for home office expenses, depreciation expenses, and the section. Be working from home to fulfil your employment duties, not just carrying out. Web to claim working from home expenses, you must: Web you need to figure out the percentage of your home devoted to your business activities, utilities, repairs, and. If you are. Home Office Expenses Form.

From loansroden.weebly.com

Tax expenses list loansroden Home Office Expenses Form Web working from home expenses. If you are required by your employer to work from home and the resulting home office expenses such. Web there are two options available to claim the home office deduction—the simplified option and the regular method. The simplified option is a quick and easy. Web to claim working from home expenses, you must: Learn how. Home Office Expenses Form.

From www.buysampleforms.com

Home Expense Form Sample Forms Home Office Expenses Form Web to claim working from home expenses, you must: Web the home office deduction, calculated on form 8829, is available to both homeowners and renters. Web working from home expenses. The simplified option is a quick and easy. Be working from home to fulfil your employment duties, not just carrying out. Web you need to figure out the percentage of. Home Office Expenses Form.

From db-excel.com

Spreadsheet And Expenses Expense Worksheet Excel New — Home Office Expenses Form Be working from home to fulfil your employment duties, not just carrying out. Web to claim working from home expenses, you must: Web working from home expenses. Web the home office deduction, calculated on form 8829, is available to both homeowners and renters. The simplified option is a quick and easy. If you are required by your employer to work. Home Office Expenses Form.

From www.vrogue.co

Expense Report Template Xls Excel Templates Vrogue Home Office Expenses Form Be working from home to fulfil your employment duties, not just carrying out. Web the home office deduction, calculated on form 8829, is available to both homeowners and renters. If you are required by your employer to work from home and the resulting home office expenses such. Web working from home expenses. Web there are two options available to claim. Home Office Expenses Form.

From www.pinterest.com

Business Expense Spreadsheet Template Excel And Daily Expenses Sheet In Home Office Expenses Form The simplified option is a quick and easy. Web the home office deduction, calculated on form 8829, is available to both homeowners and renters. If you are required by your employer to work from home and the resulting home office expenses such. Web you need to figure out the percentage of your home devoted to your business activities, utilities, repairs,. Home Office Expenses Form.

From db-excel.com

Home Office Expense Spreadsheet Printable Spreadsheet home office tax Home Office Expenses Form Be working from home to fulfil your employment duties, not just carrying out. The simplified option is a quick and easy. If you are required by your employer to work from home and the resulting home office expenses such. Web there are two options available to claim the home office deduction—the simplified option and the regular method. Learn how to. Home Office Expenses Form.

From template.wps.com

EXCEL of Expense Claim Form.xlsx WPS Free Templates Home Office Expenses Form Web working from home expenses. Web to claim working from home expenses, you must: Web the home office deduction, calculated on form 8829, is available to both homeowners and renters. The simplified option is a quick and easy. Learn how to calculate your tax deduction for home office expenses, depreciation expenses, and the section. If you are required by your. Home Office Expenses Form.

From templatearchive.com

30 Best Business Expense Spreadsheets (100 Free) TemplateArchive Home Office Expenses Form Learn how to calculate your tax deduction for home office expenses, depreciation expenses, and the section. Web to claim working from home expenses, you must: The simplified option is a quick and easy. If you are required by your employer to work from home and the resulting home office expenses such. Web working from home expenses. Web you need to. Home Office Expenses Form.

From learningcampuspoted.z21.web.core.windows.net

Daily Expenses Worksheet Home Office Expenses Form Web the home office deduction, calculated on form 8829, is available to both homeowners and renters. Web you need to figure out the percentage of your home devoted to your business activities, utilities, repairs, and. Web working from home expenses. If you are required by your employer to work from home and the resulting home office expenses such. Web to. Home Office Expenses Form.

From www.editableforms.com

Monthly Expense Form Editable Forms Home Office Expenses Form Web you need to figure out the percentage of your home devoted to your business activities, utilities, repairs, and. If you are required by your employer to work from home and the resulting home office expenses such. Be working from home to fulfil your employment duties, not just carrying out. Web there are two options available to claim the home. Home Office Expenses Form.

From db-excel.com

Small Business Expenses Spreadsheet in Free Business Expense Home Office Expenses Form Web working from home expenses. If you are required by your employer to work from home and the resulting home office expenses such. Web you need to figure out the percentage of your home devoted to your business activities, utilities, repairs, and. Be working from home to fulfil your employment duties, not just carrying out. The simplified option is a. Home Office Expenses Form.

From templatearchive.com

30 Effective Monthly Expenses Templates (& Bill Trackers) Home Office Expenses Form Web to claim working from home expenses, you must: Be working from home to fulfil your employment duties, not just carrying out. Web there are two options available to claim the home office deduction—the simplified option and the regular method. Learn how to calculate your tax deduction for home office expenses, depreciation expenses, and the section. Web you need to. Home Office Expenses Form.